Social security offset calculator

With my Social Security you can verify your earnings. The Quick Calculator compliments of Social Security estimates your future checks but this one is about as simple as they come.

How Much Can You Expect To Get From Social Security If You Make 150 000 A Year For 20 Years Quora

This is for a Windfall Elimination Provision WEP calculation which should be used only by people who have pensions from work not covered by Social Security.

. Save to new data set. You may be able to avoid the Social Security offset if you meet one of these criteria. Permament Total Supplemental Amount¹.

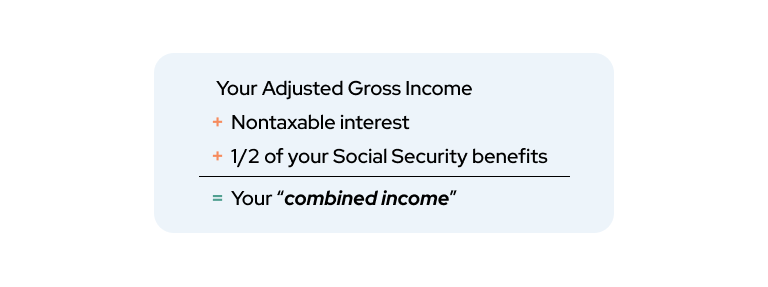

Enter the monthly amount of your non-covered pension. Your benefit may be offset by the Government Pension Offset GPO. Weekly Benefit Calculation.

Social Security pays full benefits and take the offset from your LI time loss pension voc. Enter your birth date current years. Here is how the offset to her pension will be calculated.

Greater of 80 AWW or 80 weekly ACE. And the Program Operations Manual System POMS at POMS DI 52120265. Social Security Offset per Week.

A lump sum Social Security will calculate the reduction as if you chose to get monthly benefit payments from your government work. 5 PT supplemental benefits 3 for DA on or after 1012003 000. Total Offset Available shall not exceed applicable PIA or MFB weekly compensation 000.

If your total pay in a year exceeds the maximum amount that is subject to Social Security taxes 132900 in 2019 the Social Security deduction stops and your CSRS deduction increases to. This is a link to the actual calculator. Why will my Social Security benefits.

Enter the estimated monthly amount of spouses widows or widowers benefits you. The 20 years of CSRS Offset service is divided by 40 giving a fraction of ½ 50. The offset formula according to Social Security can be found in 42 USCA.

Get the most precise estimate of your retirement disability and survivors benefits. The GPO formula reduces your Social. However instead of paying 62 of pay for Social Security plus 70 for CSRS the Social Security tax is subtracted from or offset from the 70 for CSRS.

You were age 62 or disabled before 1986 or. Money and PPD when you are ages 62 65. If you do not have a non-covered pension you should use the Online Calculator because the WEP calculation could be incorrect.

OWCP Federal Workers Compensation Benefits. However if you are eligible for a TRSL benefit the GPO may apply. Weekly Benefit After Offset.

The reduction to Debbies CSRS pension is 50 of her Social Security benefit or 6000 per year. This reduces her pension to 54000 per year. The best way to start planning for your future is by creating a my Social Security account online.

Learn How Much You Will Get When You Can Get It and More With the AARPs Resource Center. Enter the estimated gross monthly amount of the government pension in todays dollars you will receive for work not covered by Social Security. The offset is calculated using 80 of ACE as the maximum amount payable in combined workers compensation and Social Security benefits cost of living increases are excluded from the offset.

When the offset reduced your Social Security benefits to zero then it is called a total Government Pension Offset To make it easier for you to understand the impact on your retirement income the Social Security website provides a government pension offset calculator. Normally when your spouse retires on Social Security you are eligible for 50 of their benefit if you are at least age 62. It estimates how much your Social Security survivor benefits will be.

This PDF will breakdown the Federal Disability Retirement and Social Security Disability offset calculation by using an example High 3 Average. The Government Pension Offset GPO is used to calculate the reduction for a spouses or widow ers benefit. The offset during this period can be brutal.

If you do not have 30 years of Social Security covered work a Social Security WEP Calculator can assist you to calculate the complex formula that will tell you your benefit amount. You qualified for a LASERS retirement benefit including a reduced benefit by having worked at least 10 years before September 1 1985 but had not attained normal retirement age or retired prior to that date or. Ad Calculate The Best Age to Claim and How to Maximize Your Social Security Benefits.

The offset applies only to Social Security benefits as a spouse or widow or widower. The Windfall Elimination Provision WEP affects members who apply for their own not spousal Social Security benefits. Understanding Creditable Years of Service.

However we may reduce your own benefits because of another provision. Government Pension Offset Released. The Government Pension Offset GPO adjusts Social Security spousal or widower benefits for people who receive non-covered pensions A non-covered pension is a pension paid by an employer that does not withhold Social Security taxes from your salary typically state and local governments or non.

If you have a Notice of Award from the Social Security Administration it may have already performed the computation to arrive at 80 of the ACE. Download this PDF and calculate how much you could be receiving from both benefits at the same time. Work Comp Benefit Amount.

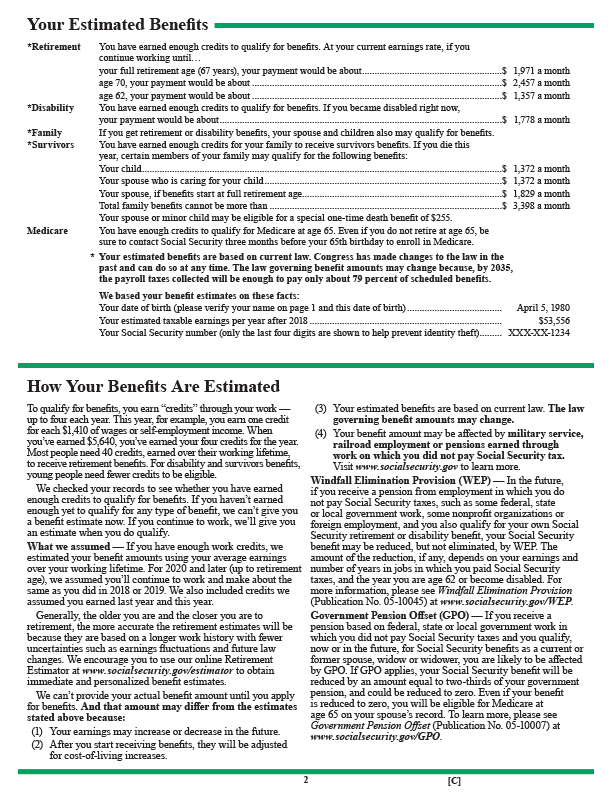

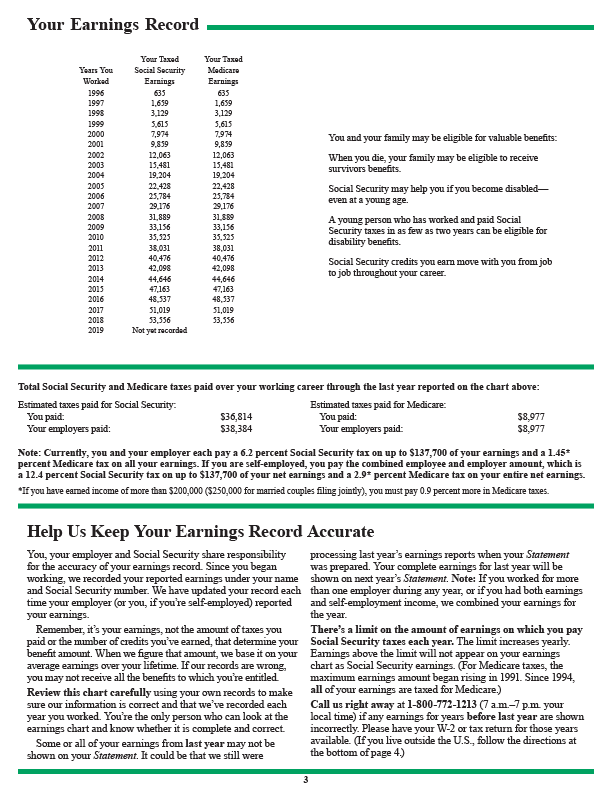

Analysis Of Benefit Estimates Shown In The Social Security Statement

The Long Term Benefits Of Delaying Social Security

Work Related Overpayments To Social Security Disability Insurance Beneficiaries Prevalence And Descriptive Statistics

The Long Term Benefits Of Delaying Social Security

Social Security Benefits Paycheck Tools National Payroll Week

Social Security Sers

Working After Retirement Rules Benefits And Social Security

When Is The Best Time To Collect Social Security

How Are Disability Ssdi Benefits Calculated In Pennsylvania

Analysis Of Benefit Estimates Shown In The Social Security Statement

Pera And Social Security Pera On The Issues

How Are Social Security Spousal Benefits Calculated Open Social Security

Opinion Fix The Unfair Gpo Calculation Within Social Security Marketwatch

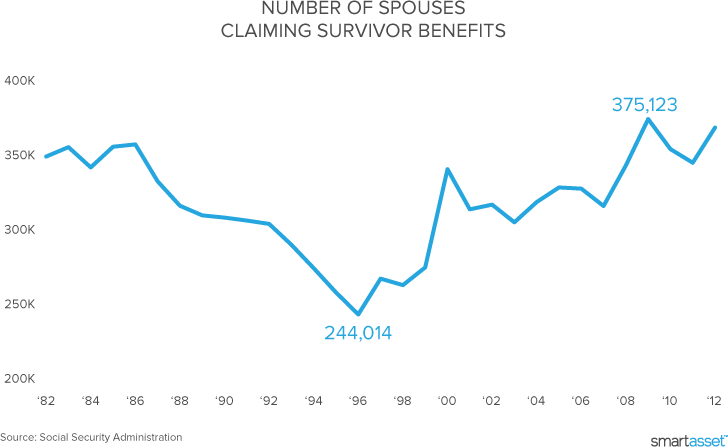

Calculate Your Social Security Death Benefits Smartasset Com

The Long Term Benefits Of Delaying Social Security

Analysis Of Benefit Estimates Shown In The Social Security Statement

Analysis Of Benefit Estimates Shown In The Social Security Statement